Financial Advisor Ratings - The Facts

Wiki Article

The Main Principles Of Financial Advisor Certifications

Table of ContentsIndicators on Advisor Financial Services You Should KnowAdvisor Financial Services Can Be Fun For EveryoneThe smart Trick of Financial Advisor Salary That Nobody is DiscussingExcitement About Financial AdvisorThe 5-Second Trick For Financial Advisor Near Me

If you're looking for a consultant to manage your money or to help you invest, you will require to satisfy the advisor's minimal account requirements. financial advisor jobs. Minimums differ from expert to advisor.

One more easy method to locate financial advisor choices near you is to use a matching service. Smart, Asset's totally free financial advisor matching device can aid with this, as it will certainly combine you with as much as three local monetary advisors. You'll after that have the ability to interview your suits to locate the ideal fit for you.

Not known Facts About Financial Advisor License

Before meeting with an expert, it's an excellent suggestion to think about what type of consultant you require. Begin by thinking of your monetary situation and also objectives. Advisors in some cases specialize to come to be professionals in a couple of elements of individual money, such as taxes or estate preparation. If you're looking for specific advice or services, consider what type of monetary consultant is an expert in that location.

Which one should you collaborate with? We locate that, mostly, individuals looking for economic advice understand to search for a monetary advisor that has high levels of integrity and who wishes to do what is in their customers' benefit in all times. It appears that fewer people pay interest to the positioning of their economic expert prospects.

The Single Strategy To Use For Financial Advisor Definition

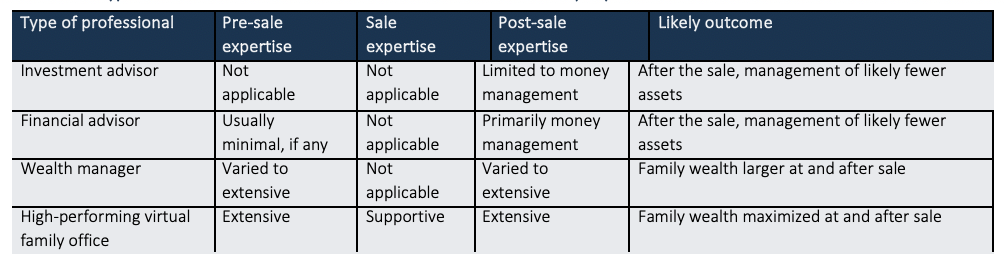

Right here's a consider four various kinds of experts you are most likely to encounter and also just how they pile up versus each other in some key locations. Equipped with this information, you must be able to much better evaluate which kind is best fit for you based upon variables such as your objectives, the complexity of your financial situation and also your internet well worth.Investment advisor. Investment consultants are excellent economic specialists that do a very excellent job handling moneybut that's all they do. While investment experts offer a single solutionmoney managementthat one remedy can have numerous variations (from securities to investments in private business, genuine estate, artwork as well as so forth).

In order to work as a monetary expert, one have to initially acquire the needed education by taking financial expert courses. Financial experts need to contend the very least a bachelor's degree, as well as in many cases a master's is suggested. One of the most prominent majors for economic consultants are money, business economics, accountancy, and service.

The 10-Minute Rule for Financial Advisor Certifications

Financial consultants will certainly require this foundation when they are encouraging clients on minimizing their threats as well as saving cash. When working as a monetary advisor, financial advisor credentials expertise of financial investment planning may prove essential when trying to create financial investment techniques for clients., such as transforming a headlight or an air filter, but take the auto to a mechanic for big jobs. When it comes to your financial resources, though, it can be trickier to figure out which work are DIY (financial advisor certifications).

There are all sort of financial pros available, with lots of different titles accounting professionals, stockbrokers, cash managers. It's not constantly clear what they do, or what sort of problems they're furnished to manage. If you're moved here really feeling out of your deepness monetarily, your initial step should be to learn who all these various economic experts are what they do, what they bill, and what choices there are to hiring them.

Rumored Buzz on Financial Advisor Magazine

1. Accounting professional The primary factor the majority of people employ an accounting professional is to aid them prepare and file their tax obligation returns. An accountant can aid you: Complete your income tax return properly to avoid an audit, Locate deductions you may be losing out on, such as a office or childcare reductionSubmit an extension on your tax obligations, Invest or give away to charities in manner ins which will decrease your tax obligations later If you have browse around these guys a business or are beginning a side service, an accounting professional can do other work for you.

Your accountant can also prepare financial statements or records. How Much They Cost According to the National Society of Accountants, the average price to have an accountant submit your tax obligations varies from $159 for a straightforward go back to $447 for one that includes organization earnings. If you desire to employ an accountant for your company, the cost you pay will rely on the size of the firm you're taking care of and the accountant's degree of experience.

Report this wiki page